By Neil Zaman

By Neil Zaman

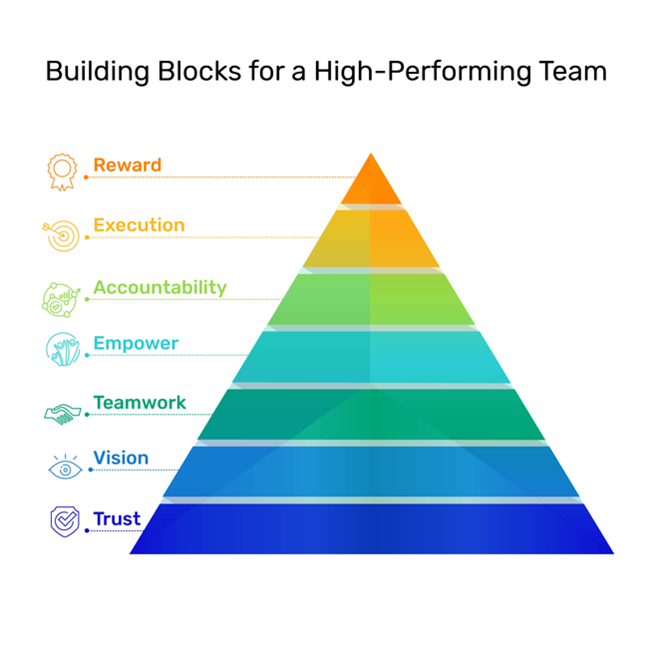

While there are certainly many opinions on how to build successful teams, here’s one roadmap for constant improvement based on the Triangle Model. When followed, this model can lead to increased innovation, improved individual satisfaction, more effective communication, better decision making, and higher quality execution. And what sales team can’t use all those?

Below are seven key principles for building out a team – with explanations of how these principles can help an organization up the ante.

1. Trust

Trust is the foundation on which all successful teams are built, and that requires an unwavering belief that everyone is driving toward the same strategic goals. This is the most critical component when building a high-performing team.

When laying out that foundation, begin by ensuring everyone is in a position that matches their skillset. If people are in positions where the opposite is true, the overall team trust will be on shaky ground.

Communicate with and learn from your employees and explain why you’ve strategically placed them where you have – reinforcing that you believe they can succeed in this role. Show employees you trust them by allowing them to make decisions, and back them up if questions arise. Employees will feel the trust and empowerment when they know you have their backs.

2. Vision

Once you are on your way to building out your team of strong contributors, you’ll need to share a clear, simple vision that is aligned all the way to the top-line corporate strategy. The vision should be lofty, but the most important part is that it’s actionable for everyone.

As an example, strive to delight customers – and talk about this all day, every day. This means the actions and decisions we make must be aimed at ensuring our customers are successful. Within the overarching vision, there can be several goals to support it, such as, “Improve customer support by X%,” or, “We plan to introduce a new product this year at a specific number of customer sites.”

3. Teamwork

Be mindful that some may feel isolated at work rather than feeling like part of a cohesive team. Highly distributed teams and improper positioning can cause challenges – as can a management team that doesn’t reinforce a team-centric mentality.

Drive inclusion by encouraging each and every team member to bring creative ideas to the table to solve problems or provide input for important decisions. Everyone has individual roles and responsibilities, but there’s usually some kind of crossover with other peers and cross-functional groups within the company. Facilitating crossover leads to a “we are in this together” sentiment.

Foster a team mindset within the organization by instilling incremental checkpoints to ensure you’re on the right track.

4. Empowerment

When you’ve completed the above steps, it’s time to let the team perform. Find ways to empower them so they can earn wins that pay off for the broader organization.

Team members are often more productive and perform at their peak when you get out of their way. It’s critical that team members have opportunities to grow and execute on their own. Be ready to guide, but first set the stage, agree on the goals, and let the teams and contributors establish their own success strategies.

5. Accountability

Bringing accountability to the table helps build trust and understanding within your team. Similar to building a trust foundation, accountability helps reinforce the trust that is already present.

To build accountability, establish clear goals from the top down that can be measured with each individual – and have regular check-ins to track key milestones. By staying on top of progress, you are avoiding surprise and establishing predictability. Demonstrating accountability when it comes to objectives – and being transparent about successes and misses – elevates the organization.

6. Execution

Building a high-performing team that drives innovation and growth is incredibly challenging, and I’ve found that pushing execution and follow-through is sometimes overlooked.

Instead of being paralyzed by planning and analysis, remind the team of your shared vision and push them to execute on it. Instead of complacency, develop an agile and customer-focused approach.

7. Reward

After you’ve built your high-performing team and are in a success pattern, don’t forget to acknowledge and reward your team members.

Money isn’t always the answer. Sometimes just giving someone the credit in front of a group can go a long way. With repeat successes, you can look at opportunities to expand your team members’ responsibilities and consider promotions. The recognition can be very motivating and fuels the continued success of the individual, the team, and the broader company.

Building a team and leading it to success requires a lot of steps. If any step within this model breaks down, the entire foundation can become weak – leaving you with lost opportunities.

Using this triangle model, you too can enable your team to succeed. You may want to put your own twist on the model so it’s true to your own leadership style. But always put your customers first.

Source: Selling Power

The question is, how to make it really work for you? A few secrets of success from a company that has been remote right from the start.

The question is, how to make it really work for you? A few secrets of success from a company that has been remote right from the start.

By Ram Charan

By Ram Charan